Blue pig piggy bank and coin pile, the concept of growing, saving and investing in business.

Hey there, financial trailblazers! Welcome to the captivating world where money matters and your little ones are about to embark on an epic adventure. Buckle up as we explore the secrets of budgeting, saving, and setting sail towards a financially savvy future for your children!

Why Saving is the Ticket to Financial Freedom for Children

Okay, parents, picture this: saving money isn’t just about piggy banks; it’s about teaching your children to be the captains of their financial ships. First off, it’s like planting the seeds of responsibility and self-discipline. It’s showing them the magic of patience and how good things come to those who save smartly.

Let’s talk about having a safety net! Think of it as a shield against surprise expenses. Whether it’s a broken gadget or an unexpected adventure, having savings tucked away is like being prepared for whatever life throws their way.

But wait, there’s more! Saving money is their secret weapon for dreams. From higher education to chasing their passions, saving early means they’re charting their own course without depending on anyone else.

Why Guiding Children Through Money Skills is a Game-Changer

Parents, here’s the scoop: teaching money management skills is like handing them a treasure map for life. It’s about steering them clear of financial storms as they grow up. Imagine your children making smart money choices and navigating their financial adventures like pros.

What if they could sail through life’s money hurdles without a hitch? When children learn to handle money early on, they grow up to make informed choices and sidestep those pesky financial potholes.

Perks of the Money-Saving Game for Children

Saving money isn’t just about hoarding coins; it’s a superpower that unlocks a treasure chest of benefits! It’s like equipping them with a shield to make those savvy choices with their cash.

Hold on tight, parents! Saving helps children gain independence. Prioritizing their cash teaches them to rely less on others. Feeling like a financial superhero yet? They’re on their way!

It’s not just about saving; it’s also about boosting their work ethic! Watching their savings grow feels like getting a high-five for their efforts. It’s that spark of motivation that keeps them hustling towards their goals.

Where Money Magic Begins: Simple Investments for Children

Parents, here’s the inside scoop on how your young explorers can start their financial journey:

1. Savings Account: It’s like planting seeds in a treasure garden! Opening a savings account at a bank is safe and teaches them the magic of earning interest on their savings.

2. Stocks: For your older adventurers, exploring the stock market under the guidance of their guardians is like embarking on an exciting quest where the seeds they plant can grow into something bigger over time.

3. Investing in Learning: Encourage them to invest in learning new skills. It’s like unlocking doors to a world of opportunities.

4. Self-Investment: Let them explore hobbies or activities that ignite their passions. It’s their way of investing in themselves.

Real-Life Financial Adventures for Children

Teaching money isn’t just about numbers; it’s about thrilling real-life scenarios. Involve your children in family budgeting sessions. It’s like solving a mystery and understanding why money moves where it does.

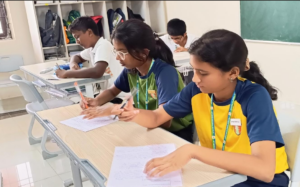

Imagine experts visiting schools to share their tales! Learning from their experiences is like uncovering secrets from a treasure map.

And here’s the kicker: tying money to subjects like math or social studies is like revealing the magic behind real-life decisions. It’s like uncovering how numbers wield their power in our day-to-day adventures.

Wrapping Up

Parents, saving money isn’t just about hoarding coins; it’s a toolkit for a secure future. Teaching money skills early means steering clear of financial storms in their adulthood. It’s about nurturing their superhero skills and independence and guiding them toward making wise, savvy choices. Athena Global School prioritizes financial education in its syllabus so that students can be empowered to make informed financial decisions and set them on a path toward financial success. We also encourage our students to participate in the NFLAT- National Financial Literacy and Assessment Test conducted annually. Let’s arm our children with money superpowers and set them on a course for a future that shines brighter than gold!